Understanding Property Assessments and Your Taxes

January 7, 2019

2019 property assessments have been mailed to all property owners in the province. According to BC Assessment, the average Courtenay single-family home increased in value by 17%. Many communities across BC have experienced higher than average property assessment increases this year.

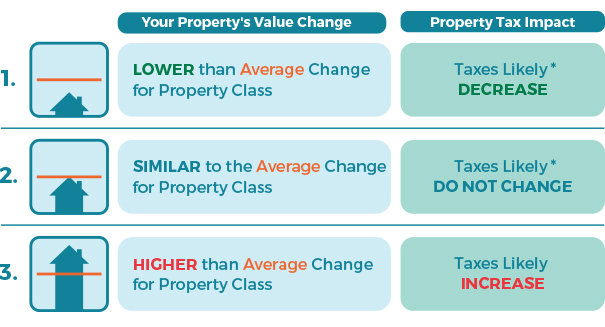

It’s important to note that a property assessment increase doesn’t necessarily result in a significant increase to property taxes. What matters is how an individual property assessment changed in comparison to the average % change in property assessments in the municipality.

*The diagram above assumes that there are no changes in the distribution of budget funding between property classes for your taxing jurisdiction and/or any other taxing agency.

*The diagram above assumes that there are no changes in the distribution of budget funding between property classes for your taxing jurisdiction and/or any other taxing agency.

The following information will help you understand the relationship between property assessments and property taxes. Some of these points are specific to the City of Courtenay, but the general information on assessment value would apply to any residential property owner. If you have questions about Courtenay property taxes, staff in the City of Courtenay’s Finance Department would be happy to assist you.

Questions about your assessment should be directed to BC Assessment - their contact information is at the bottom of this page.

- A property owner with a larger than average property assessment increase could see an increase to their city property taxes, while someone with a lower than average assessment increase could potentially experience a property tax decrease, depending on the tax rate.

- The overall city budget is developed based on the cost of delivering services to residents. Taxes collected by the City of Courtenay support fire and police services, road maintenance, parks, administration, recreation, and cultural facilities. The City of Courtenay’s Asset Management Policy emphasises Sustainable Service Delivery, ensuring that “current community services are delivered in a socially, economically, and environmentally responsible manner that does not compromise the ability of future generations to meet their own needs.”

- Of the property taxes collected by the City of Courtenay, just over half remains with the city. The rest is collected on behalf of other taxing authorities, such as the Comox Valley Regional District, schools, hospital, BC Assessment, Vancouver Island Regional Library, and Municipal Finance Authority. The city does not control these charges.

- The Finance Department is currently developing the 2019 budget which is expected to be finally adopted in April. Property tax notices will be mailed out in late May 2019.

- The City of Courtenay does not determine property assessment values and cannot alter them. Property owners may appeal assessments by making application to the BC Assessment Authority prior to January 31, 2019 by following the steps at their website: www.bcassessment.ca or calling them toll free at 1-866-825-8322

The following information from BC Assessment may also be helpful.

Property Assessments and Property Taxes: A not-so complicated relationship

BC Assessment Interactive Market Trend Maps

Contact BC Assessment:

Toll-Free Number: 1-866-valueBC (825-8322)

Outside North America Number: 604-739-8588

Fax Number: 1-855-995-6209

BC Assessment’s website www.bcassessment.ca