Your municipal property taxes help fund:

- Essential services such as police, fire fighting and emergency rescue.

- Recreation and community centres, libraries, parks and more.

- Services and support programs to build stronger communities.

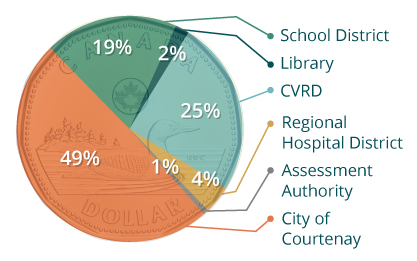

The City of Courtenay receives around half of your tax payments. The remainder goes to other taxing authorities, including:

- Comox Valley Regional District

- School District 71

- Comox Strathcona Regional Hospital District

- BC Assessment

- Vancouver Island Regional Library

- Municipal Finance Authority

The City does not control these additional charges.

Image